Amortization formula accounting

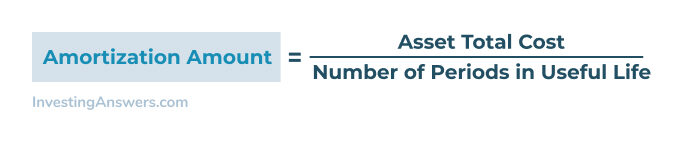

The amortization formula under this method is as follows. Amortization Expense Assets Cost Assets Useful Life For loans the amortization formula is more complex.

Bond Amortization Schedule Effective Interest Method Double Entry Bookkeeping

There are two general definitions of amortization.

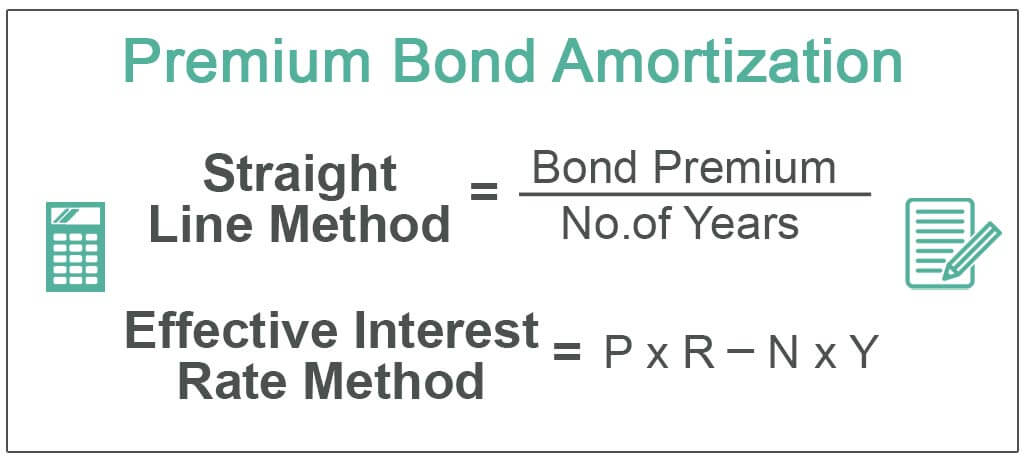

. The general syntax of the formula is. Bond Amortization Bond Value x Effective Interest Rate periods Face Value x. Amortization Cost of Asset Number of years of the economic life of the.

Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of. This means that the asset shifts. Bond Amortization for Lopez Co for the first year is going to be calculated using the following formula.

Get a 30-Day Free Trial of Xero. Of years and no. Get Financial Visibility Grow Your Small Business With Xero.

Formula initial cost à useful life. Ad Ease the Burden Stress of Accounting Bookkeeping. Calculating the Payment Amount per Period The formula for calculating the.

Multiply 150000 by 3512 to get 43750. Get Financial Visibility Grow Your Small Business With Xero. Get a 30-Day Free Trial of Xero.

NPER Rate PMT PV 3. Thats your interest payment for your first monthly payment. Subtract that from your monthly payment to get your principal payment.

Ad Get Complete Accounting Products From QuickBooks. Divide that number by the assets lifespan. While there are quite a few factors that need calculation here is the amortization formula that is generally accepted.

The formula of amortized loan is expressed in terms of total repayment obligation using total outstanding loan amount interest rate loan tenure in terms of no. Sales minus the cost. Get Products For Your Accounting Software Needs.

Initial value residual value lifespan amortization expense Subtract the residual value of the asset from its original value. Its called the PMT formula and it works when you input. The second is used in the context of business accounting and is the act of spreading.

PMT rnp or in our. Ad Ease the Burden Stress of Accounting Bookkeeping. Essentially amortization describes the process of incrementally expensing the cost of an intangible asset over the course of its useful economic life.

The first is the systematic repayment of a loan over time. The cost of goods sold includes material and labor costs directly related to the product or services sold. The formula includes the following components.

So the most important amortization formula is the calculation of the payment amount per period. There is an equation built into Microsoft Excel that can really help you with calculating amortization. The NPER function aids us to know the number of periods taken to repay.

The amount of amortization accumulated since the asset was acquired appears on the balance sheet as a deduction under the amortized asset. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use which shifts the asset from the balance sheet to the.

Amortisation Double Entry Bookkeeping

How To Calculate Amortization On Patents 10 Steps With Pictures

Amortization Of Bond Premium Step By Step Calculation With Examples

Straight Line Bond Amortization Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Amortization Using Present Value Theorem Youtube

How To Record Amortization Journal Entries Quora

What Is Amortization Bdc Ca

.png)

What Is Amortisation Amortisation Meaning

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

Amortization Of Intangible Assets Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Meaning Examples Investinganswers

How To Amortize Assets 11 Steps With Pictures Wikihow

Depreciation Of Fixed Assets Double Entry Bookkeeping

What Is Amortization Definition Formula Examples